A Comprehensive Guide to Understanding Colorado Tax Refund:

Tax season can often be a source of confusion and anxiety for many individuals, especially when it comes to understanding refunds. This article aims to demystify the Colorado tax refund process, discussing everything from the state’s income tax framework to eligibility requirements and tips for expediting the refund process.

According to DENVER:https://www.denver7.com/money/tabor-refunds-are-coming-in-2025-colorado-heres-how-much-you-can-expect-to-get-next-year

If you’re a Colorado taxpayer who loves a tax rate reduction and TABOR refunds, we’ve got good news for you: You’re getting both in 2025.

In a report published late last month, the Colorado Office of the State Auditor reported that the state saw an excess revenue of approximately $1.4 billion in fiscal year 2024 which, when combined with what was left over from the prior year, amounted to a total of about $1.7 billion in excess revenue — enough to trigger all three of the refunding mechanisms under TABOR.

What is Colorado State Income Tax?

Colorado’s state income tax is a key part of the state’s revenue system. Unlike many other states that have a progressive tax rate structure, Colorado employs a flat tax rate. As of the 2022 tax year, this rate is set at 4.55% of federal taxable income, meaning that all income levels are taxed at the same rate. This simplifies the tax process but can still leave many residents unsure about their obligations and expected refunds.

READ ALSO: Rocket Mortgage

How Does Colorado State Income Tax Work?

1. Filing Requirements: Most residents are required to file a state tax return if they meet specific income thresholds.

2. Tax Deductions and Credits: Colorado offers various deductions and tax credits that can lower your taxable income, such as the standard deduction and itemized deductions.

3. Withholding: Employers typically withhold state income taxes from employee paychecks, which contributes to the amount that can be refunded at tax time.

Colorado Tax Refund Basics

A tax refund in Colorado reflects the difference between the taxes owed and the taxes you have already paid through withholding or estimated tax payments during the year. In essence, if you’ve paid too much in taxes, the state provides a refund to you.

Key Features of the Colorado Tax Refund Process

1. Refund Amount: The amount of your refund will depend on your total income, applicable deductions and credits, and the amount withheld from your paychecks throughout the year.

2. Timeline for Refunds: After filing your tax return, you can usually expect your refund to be processed within a few weeks if you file electronically. Paper returns take longer to process.

3. Direct Deposit Option: Opting for a direct deposit can expedite the receipt of your refund compared to receiving a paper check.

Eligibility Requirements

Not everyone is entitled to a tax refund. Understanding the eligibility criteria will help you ascertain whether you can expect a refund:

1. Income Level: Your total income plays a significant role in eligibility. If you earn below the taxable threshold, you may not owe taxes or receive a refund.

2. Withholding and Estimated Payments: If your withholdings exceed your tax liability, you may qualify for a refund.

3. Credits and Deductions: Eligibility for certain credits or deductions, such as the Colorado Earned Income Tax Credit, can dramatically affect your refund status.

Who Might Not Get a Refund?

– Individuals with minimal income that do not meet the requirements for filing.

– Taxpayers whose tax payments equaled their liability.

– Those that fail to file a tax return altogether.

Colorado Tax Refund Options

When it comes to receiving your tax refund in Colorado, you have a couple of options:

1. Direct Deposit: As mentioned earlier, opting for direct deposit is the quickest method to receive your refund. You will need to provide your bank account information on your tax return.

2. Paper Check: If you choose not to use direct deposit, a paper check will be mailed to you. This method can take several days longer than direct deposit.

3. Colorado Prepaid Card: In some scenarios, taxpayers can opt to receive their refund via a state-issued prepaid card.

Choosing the Right Option

Choosing between direct deposit and paper checks often comes down to personal preference. However, direct deposit is generally encouraged for a faster refund experience.

How to Check the Status of Your Refund

After filing your return, knowing how to track your refund status can alleviate anxieties. Colorado has put in place several tools for taxpayers to monitor the status of their refunds:

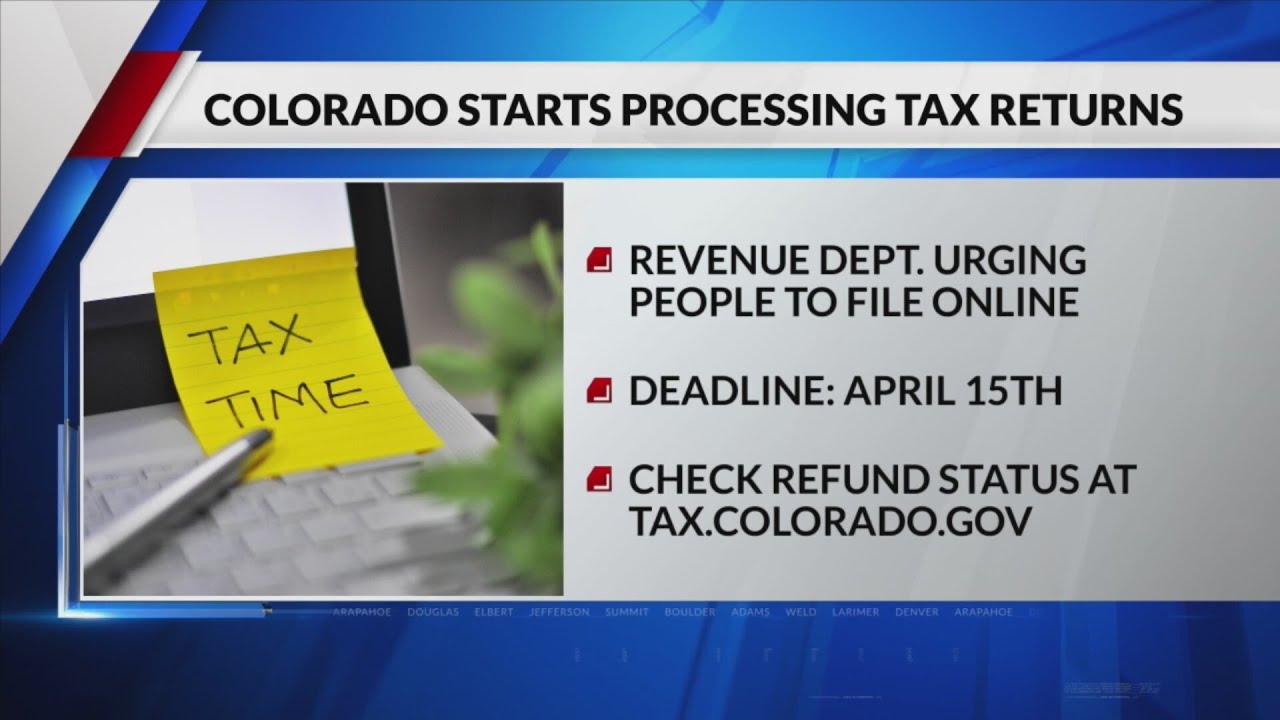

1. Online Portal: The Colorado Department of Revenue offers a website where taxpayers can check their refund status with just a few clicks. You will need to provide personal information, including your Social Security number and the amount of your expected refund.

2. Phone Inquiry: You can also contact the Colorado Department of Revenue customer service for assistance with tracking your refund.

3. Third-party Applications: There are also various tax preparation software that allow you to check your refund status directly within their applications.

Common Reasons for Delayed Refunds

Despite taxpayers’ efforts to file correctly and promptly, there are several common reasons why refunds might be delayed:

1. Incomplete Returns: Missing schedules, forms, or signatures can lead to processing slowdowns.

2. Errors in Personal Information: Incorrect Social Security numbers, names, or other identifying information can lead to significant delays.

3. Fraud Prevention Measures: The state may flag returns for additional scrutiny if they detect suspicious activity, which can also cause delays.

4. Amended Returns: If you amend your tax return after filing, processing times for refunds will naturally be extended.

Strategies to Mitigate Delays

To minimize the risk of delays:

– Double-check your return for errors before submission.

– Ensure all required forms and schedules are included.

– File your taxes early to avoid the last-minute rush and ensure timely processing.

Tips for Getting Your Refund Faster

Here are some strategic tips to help you process your refund more efficiently:

1. File Electronically: Electronic filing is not only faster, but it also reduces the likelihood of errors compared to paper returns.

2. Opt for Direct Deposit: By choosing direct deposit for your refund, you can significantly reduce the time it takes to access your funds.

3. Stay Organized: Keep all your tax documents in order and easily accessible to streamline the filing process.

4. Check and Double-check: Before submitting your return, cross-reference it against any tax forms you receive, such as W-2s, to ensure accuracy.

Conclusion

Navigating the Colorado tax refund system doesn’t have to be a daunting task. By familiarizing yourself with the state’s tax structure, eligibility requirements, and the refund process, you can ensure a smoother experience.

By being aware of how to check your refund status and implementing strategies to avoid common pitfalls, you can expedite the process and benefit from the financial relief that a tax refund provides. As you prepare for tax season, remember that knowledge is power—understanding the ins and outs of your state’s tax system will help you reap the most benefits come refund time.